Workday’s biannual feature releases are highly anticipated events, delivering innovation, AI-driven enhancements, and improved user experiences. The Workday 2025 R2 release, delivered in September, introduced hundreds of new capabilities across HCM, Payroll, and Financials.

However, beneath the surface of innovation lies an often-overlooked reality. Every new feature, retirement, or technical change introduces risk to existing configurations. For organizations

relying on reactive Application Management Services (AMS), the real cost of R2 is not the upgrade itself—but the silent exposure to system instability, compliance failures, and operational

disruption.

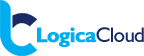

1. The Integration Conundrum: OAuth 2.0 and ISO Standards

The Workday 2025 R2 release introduced mandatory upgrades to its integration framework, designed to strengthen security and align with global financial standards. A major change is the enforced migration to OAuth 2.0 authentication, replacing legacy methods such as Basic Auth.

While this improves security, it is not an automatic transition. Existing custom integrations, particularly those connected to third-party systems, require proactive analysis, security policy

updates, and extensive testing. Organizations that fail to act before go-live risk broken integrations and critical data flow disruptions.

Financial integrations also now support ISO 20022 Version 10. Without updating templates and validation rules, payment processing delays and reconciliation errors become likely.

2. Payroll’s Perilous Path: Compliance Risks

Payroll remains the most sensitive module during any Workday release. Errors here result in immediate financial, legal, and reputational consequences. The 2025 R2 release introduced

several statutory and calculation-related updates that require careful configuration.

- Automatic adjustment of taxable wages over statutory wage limits

- Shared recoup arrears limits across multiple deductions

- Custom payroll input validations to prevent incorrect entries

A reactive AMS approach typically validates only standard payroll scenarios. This leaves complex, customized payroll calculations untested—creating significant exposure to incorrect payments, statutory non-compliance, and costly remediation.

3. Security: Mandatory Updates, Hidden Exposure

Security enhancements in Workday 2025 R2, including the new Security Admin Hub and required Time & Absence policy updates, are mandatory. However, they often introduce subtle access changes that are easily missed.

Without a full role-based security audit, organizations risk:

- Unauthorized access to sensitive employee or payroll data

- Managers losing approval capabilities for critical processes

- Operational delays and increased employee frustration

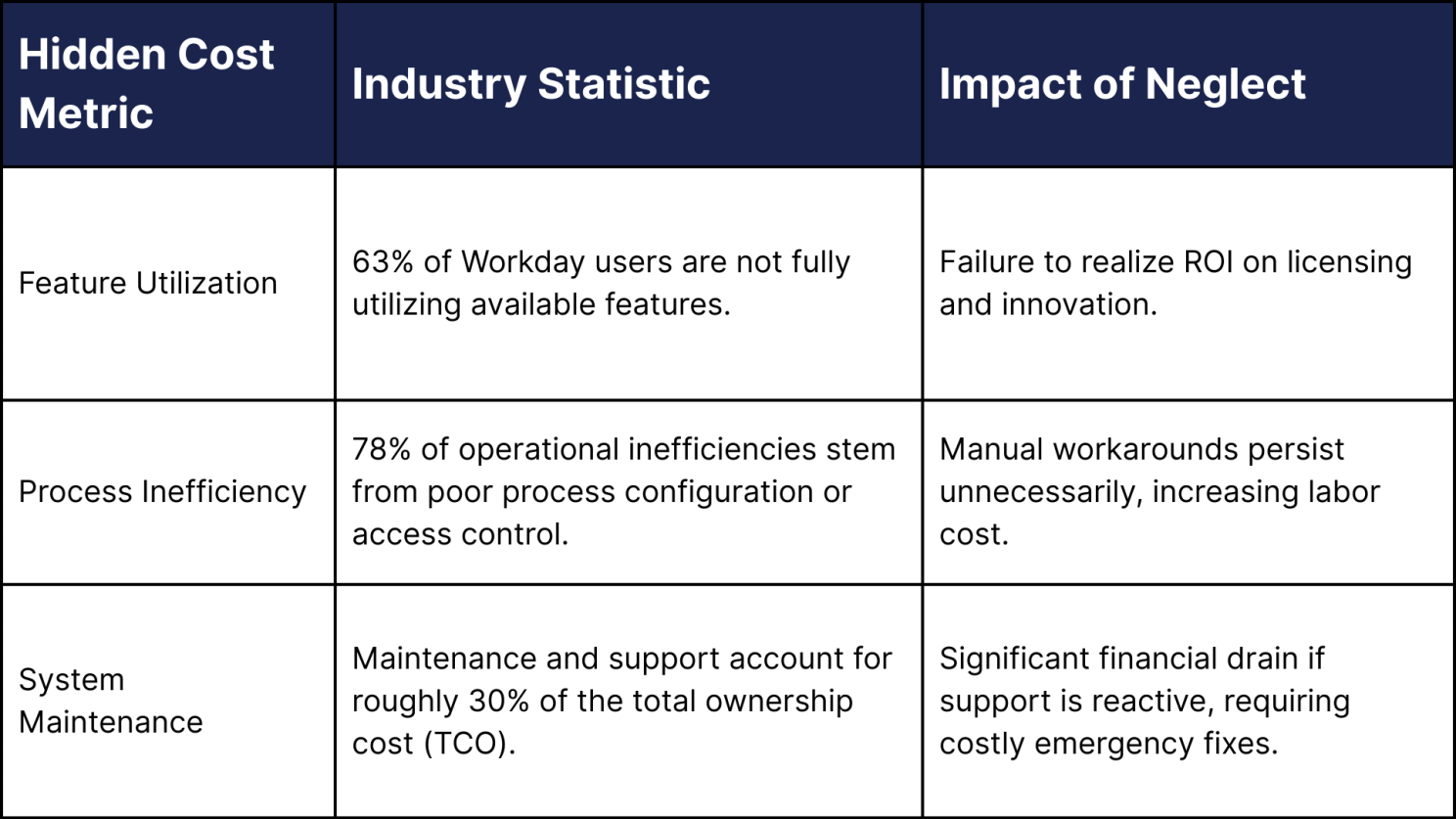

4. The Hidden Cost of Inadequate AMS Support

The true cost of a Workday release is rarely visible on day one. It emerges when AMS providers focus solely on break-fix support instead of proactive readiness. Without impact analysis, regression testing, and parallel validation, organizations face emergency fixes, extended downtime, compliance penalties, and lost productivity. Proactive AMS support prevents these outcomes by aligning preparation with Workday’s preview and release timelines.

Is Your Organization Truly R2 Ready?

Workday 2025 R2 requires more than basic testing. It demands proactive planning, deep functional expertise, and continuous validation across integrations, payroll, and security.

Act now. Ensure your Workday environment remains compliant, stable, and fully optimized for the R2 release.